Daily Pulse: Global Insights

Your daily source for news and insightful information from around the globe.

Crypto Regulation Roulette: Spin the Wheel of Compliance

Dive into the unpredictable world of crypto regulations! Spin the wheel and discover what compliance really means for your investments.

Understanding the Global Landscape of Crypto Regulations: What You Need to Know

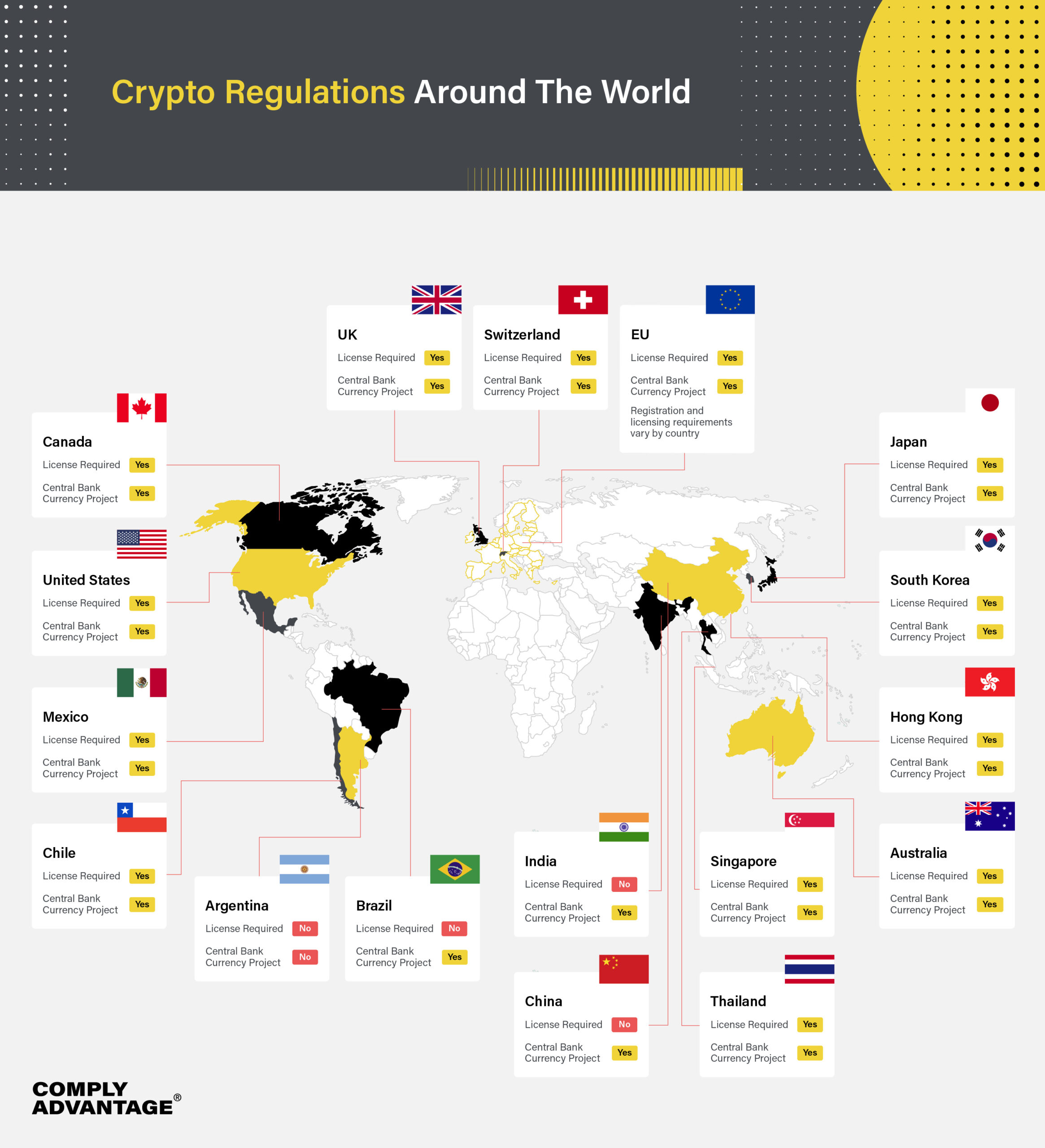

The landscape of crypto regulations is rapidly evolving, with governments and regulatory bodies around the world continuously adapting their policies to address the challenges posed by cryptocurrencies. As a result, understanding the global regulatory framework is essential for anyone involved in the crypto space. Key factors influencing these regulations include national security, consumer protection, and the need to combat money laundering. Each country approaches crypto regulation differently, making it crucial to stay informed about the specific regulations that apply to your operations or investments.

In many regions, regulations are still in their infancy, leading to uncertainty and a lack of uniformity. For instance, in the United States, the regulatory environment is characterized by a patchwork of state and federal laws, with agencies like the SEC and CFTC playing significant roles. Conversely, countries like El Salvador have embraced cryptocurrencies by adopting Bitcoin as legal tender. As a result, stakeholders must actively monitor both local and international developments, as ongoing discussions and legislative changes can have a profound impact on the global crypto market.

Counter-Strike is a highly popular first-person shooter game that pits teams of terrorists against counter-terrorists in various objective-based scenarios. Players can enhance their gaming experience by using the betpanda promo code to gain access to exclusive bonuses and features. The game's competitive nature and strategic gameplay have made it a staple in the esports community.

Is Your Cryptocurrency Investment Compliant? Key Regulations to Consider

As the cryptocurrency market continues to evolve, compliance with regulatory frameworks is becoming increasingly crucial for investors. Different countries have established their own set of rules to govern the trading and ownership of cryptocurrencies. It's essential to stay informed about the various regulations in your jurisdiction, which may include anti-money laundering (AML) laws, know your customer (KYC) requirements, and taxation implications. For instance, in the United States, the SEC has classified certain cryptocurrencies as securities, necessitating compliance with federal securities laws. Neglecting these regulations can lead to significant legal penalties and hinder your investment strategy.

Moreover, investors should not overlook the importance of understanding tax obligations related to cryptocurrency investments. Many jurisdictions treat digital currencies as taxable assets, meaning you may have to report gains or losses when filing your taxes. It's advisable to consult with a tax professional well-versed in cryptocurrency taxation to ensure you remain compliant. Additionally, staying updated on potential regulatory changes can help you make informed decisions and safeguard your investments against unexpected legal challenges.

Navigating the Regulatory Maze: How Different Countries Approach Crypto Compliance

Navigating the regulatory maze surrounding cryptocurrency can be a daunting task for businesses and investors alike. Different countries have adopted various approaches to crypto compliance, creating a fragmented landscape where regulations can differ significantly. For instance, the United States utilizes a patchwork of federal and state laws, requiring compliance with multiple agencies like the SEC and FinCEN. In contrast, the European Union is moving towards a more unified regulatory framework with comprehensive proposals such as the Markets in Crypto-Assets (MiCA) regulation. This divergence in regulatory approaches can impact everything from taxation to the legality of certain crypto activities.

Countries like Japan and Switzerland are often viewed as leaders in crypto regulation, having established clear guidelines that foster innovation while safeguarding investors. Japan’s Financial Services Agency (FSA) imposes rigorous standards for exchanges, while Switzerland’s progressive stance has created a thriving crypto hub with clear legal definitions. Conversely, nations with less defined regulations, such as some in Africa and Asia, present both opportunities and risks, as the lack of oversight can facilitate innovation but also leaves investors vulnerable to scams. As the global crypto market evolves, staying informed about how different countries approach crypto compliance is essential for anyone looking to navigate this intricate maze.