Daily Pulse: Global Insights

Your daily source for news and insightful information from around the globe.

Digital Wallet Integrations: The Key to Your Business's Financial Freedom

Unlock financial freedom for your business with seamless digital wallet integrations. Discover how to boost your revenue now!

How Digital Wallet Integrations Can Transform Your Business's Financial Operations

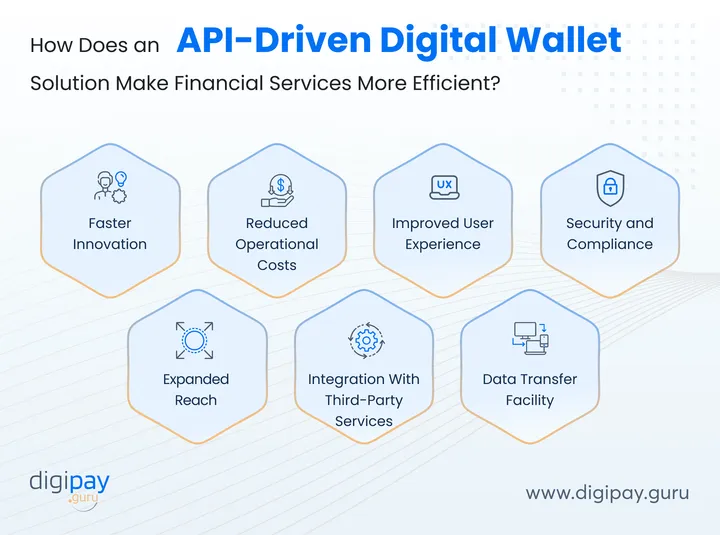

In today's fast-paced digital landscape, digital wallet integrations are rapidly becoming essential tools for businesses aiming to streamline their financial operations. By adopting these technologies, companies can easily process transactions, enhance payment security, and provide a more convenient shopping experience for their customers. Integrating a digital wallet allows for quicker checkouts and reduces the hassle of handling cash or traditional credit card transactions. This seamless transaction process not only fosters customer satisfaction but also helps businesses reduce operational costs through decreased transaction fees and fewer chargebacks.

Furthermore, the implementation of digital wallet integrations can facilitate better financial tracking and management. With real-time reporting and analytics, businesses can gain deeper insights into their cash flow and customer spending behaviors. This data-driven approach enables business owners to make informed decisions, optimize inventory levels, and personalize marketing efforts for improved customer engagement. As technology continues to evolve, companies that embrace digital wallets stand to gain a competitive edge in their financial operations, all while meeting the demands of the modern consumer.

Counter-Strike is a popular first-person shooter game that pits teams of terrorists against counter-terrorists in various objective-based scenarios. Its competitive gameplay has led to numerous tournaments and an extensive esports scene. Players often seek ways to enhance their gaming experience, including various promotions; for example, you can check out the betpanda promo code for exciting offers.

The Benefits of Embracing Digital Wallets: A Guide for Modern Entrepreneurs

In today's fast-paced business environment, embracing digital wallets has become an essential strategy for modern entrepreneurs. By adopting this technology, you can streamline your payment processes, enhancing customer experience and satisfaction. Digital wallets not only offer convenience but also improve security by minimizing the risks associated with handling cash and traditional credit cards. For instance, utilizing platforms like PayPal, Apple Pay, or Google Wallet can help you attract tech-savvy customers who prioritize quick and safe transactions.

Moreover, incorporating digital wallets into your business model can lead to significant cost savings. With lower transaction fees compared to credit card processing, you can allocate more resources towards growth and innovation. According to a recent study, businesses that implemented digital payment solutions witnessed an increase in sales by up to 20%. It's an investment that not only simplifies payment but aligns your enterprise with the evolving preferences of the digital age.

Is Your Business Ready for Digital Wallet Integrations? Key Questions to Consider

In today’s fast-paced digital landscape, integrating digital wallets into your business can provide significant advantages. However, before making the leap, it's essential to ask yourself several key questions. Firstly, do your customers demand this payment option? With an increasing number of consumers preferring contactless payments, conducting market research is crucial. Additionally, consider whether your current payment infrastructure can support digital wallet integrations. Analyzing your existing systems will help ensure a smooth transition and enhance customer satisfaction.

Another important aspect to consider is security. Are you equipped to handle the heightened security measures that come with accepting digital wallets? Implementing secure payment protocols is essential to protect both your business and your customers' sensitive information. Lastly, evaluate your competition. Are other businesses in your industry adopting digital wallet integrations? Staying informed about industry trends can help keep your business competitive and align your offerings with customer expectations.